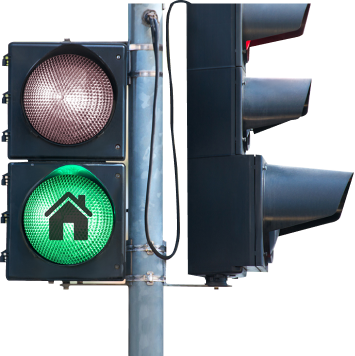

Work out and see your loan eligibility fast online

Planning on renovating? Then your file will already be sorted and we won't have to call you.

Planning on renovating? Then your file will already be sorted and we won't have to call you.

Planning on renovating? Then your file will already be sorted and we won't have to call you.

Form of credit: mortgage loan for immovable property. Subject to your loan application being approved by KBC Bank NV. Lender: KBC Bank NV, Havenlaan 2, 1080 Brussels, VAT BE 0462.920.226, RLP Brussels.