International expansion

Your international growth plans are assured of success thanks to:

- Our good cooperation in Belgium which we continue seamlessly abroad

- Rapid start-up due to our knowledge of the local banking and insurance industry

- Local financial solutions tailored to your business

Thinking of expanding abroad?

An international office is more than just a copy of a Belgian office. Doing business abroad is a little different from doing business in Belgium. The added value lies in our good cooperation in Belgium, which we continue seamlessly with our trusted partners abroad. This gets your activities abroad off to a head start.

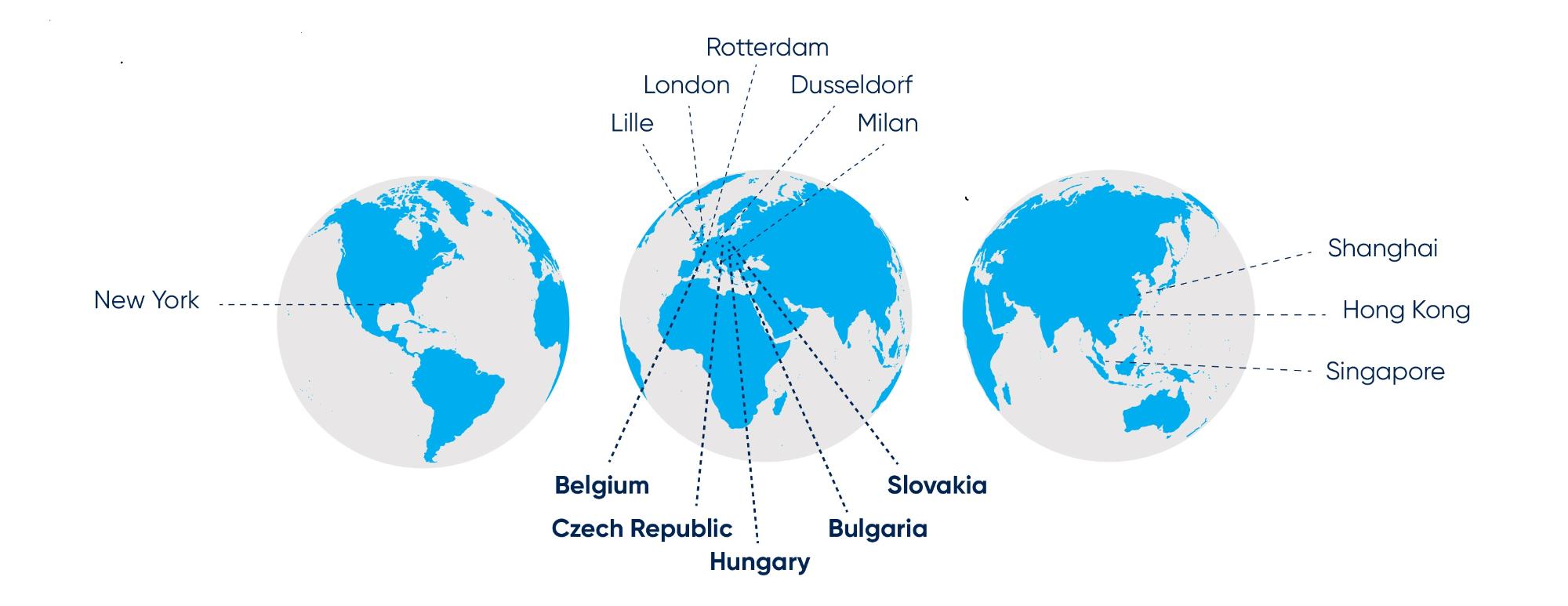

Where do you want to go? Find out in which countries we can help your business grow

With our international network, our international expertise, and most importantly, the right people, we can get you up and running quickly.

If you operate in one of our five home markets, we can support your growth plans from our network of nine international offices. To make this possible, we offer our customers a streamlined approach: one bank, one way of working! All the coordination is carried out in Belgium by your trusted dedicated team who already know your business inside out.

Even abroad, we literally and figuratively speak your language. As a customer, you never feel you have to build a new relationship with our people abroad. It's just the same relationship we already have with you here, which we simply continue there. Whether you walk into our office in Hong Kong or your local office at home in Belgium, you don't have to explain again who you are, what you do, what you need. The people who speak to you already know you.

Wim Eraly - Senior General Manager at KBC Commercial Banking

Get off to a head start, thanks to our local expertise

Your KBC contact is the experienced guide you need to do business abroad successfully. Together with their staff teams, they are experts in local banking and insurance and know the regional requirements like the back of their hands. They network with local business communities, government departments and diplomatic circles.

You as an entrepreneur don't need to familiarise yourself with these things at all; that not only saves you a lot of time and energy, it also gives you a strong commercial edge over your competitors.

It’s helpful to have a dedicated contact and to be able to call on local expertise so we can act quickly when needed.

Jan Boone, CEO of Lotus Bakeries

Whatever your plans, we’ll help you with the right solutions!*

Customised payment solutions and optimum cash management

- The KBC Reach application in your familiar Business Dashboard ensures efficient management of all your foreign accounts.

- Optimum management of your liquidity is assured thanks to domestic or international pooling.

- Work seamlessly with foreign payment platforms such as EBICS in Germany and payment technologies such as the French LCR and Italian RIBA thanks to our customised digital applications.

- We offer short and long-term finance tailored to the specific market where

- Optimising your working capital is easy with our KBC Commercial Finance solutions and the ComFin Touch application.

Managing international trade and currency risks

-

We offer .a complete range of credit solutions for your import or export transactions. - We help mitigate payment and cash flow risks with foreign buyers or suppliers.

- We provide foreign currency solutions and help you manage currency and interest rate risks.

*We provide tailor-made solutions; these may differ from country to country.

Use the Swift GPI Tracker to easily keep track

of your international payments:

- Payment receipt available digitally

- Always the correct payment status

- No delays due to payments

Other clients recount their international growth story

Come and talk to us

Like more information on our offer or want to discuss your plans? Your relationship manager at KBC will be happy to help you further!