Open a young person’s account and get a free power bank!

Now that you’re old enough to choose your own bank, it’s worthwhile to take a moment and carefully consider your options. Get more from your current account with KBC.

As an under 25-year-old, you get a free KBC Plus Account, which is ideal for convenience banking and learning how to become money savvy.

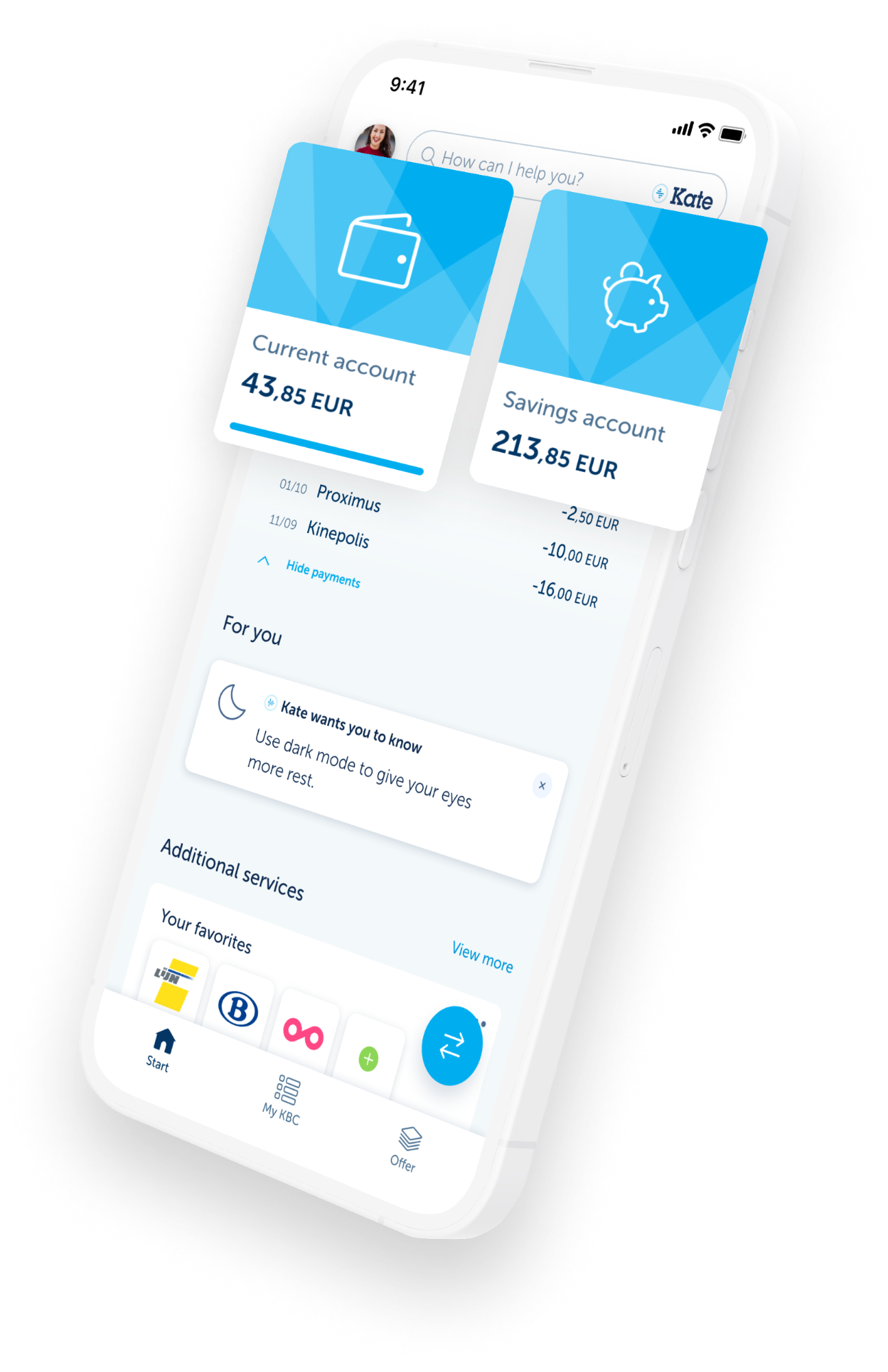

- Use the best banking app in Belgium

- Save time and money with Kate

- Take your first steps as a young investor

- Apply for a free credit card*

And as if that’s not enough, you’ll also receive a gift in the form of a handy power bank. You just have to open your young person's account and download KBC Mobile. But be quick ... the offer is time-limited!

*Remember, borrowing money also costs money

KBC Mobile is bursting with interesting and useful features for young people. Of course, you can still easily transfer funds and save money. But KBC Mobile lets you do so much more:

- Withdraw cash without a card

Card not on you? No problemo! Use your phone to withdraw money thanks to MobileCash

- Practise for your driving theory test

Test yourself by doing the VAB Driving School's mock exam - Split group expenses

Enjoying an evening out? Easily keep track of how much everyone has paid and who owes what - Goal Alert

Watch the highlights and goals from the Jupiler Pro League exclusively in KBC Mobile - And that’s not all!

The app is only getting better, with new features for young people constantly being added. No wonder it’s been named best banking app in Belgium!

Kate offers assistance with your banking and makes your young life so much easier. And if that’s something you don't give much thought to, she’ll do it for you by providing resourceful tips.

Whether it’s changing your payment limit, finding a transaction or forgetting your PIN, Kate is on hand to help you out around the clock.

Of course, you can also get in touch with KBC Live, where our staff will be happy to help you and provide advice.

Get cash back from your favourite shops

It’s not only Kate’s tips and tricks that save you money, Kate Coins too enable you to pick up tidy cashback rewards. If you pay with your KBC young person’s account at a participating shop (either online or in-store), you’ll earn Kate Coins to spend again at one of our partners. It couldn’t be easier!

The younger you start investing, the better the prospects. But how do you get started?

Another reason to choose our young person’s account is because of the low-threshold options we provide in helping you take your first steps as an investor. For instance, you could start automatically investing your spare change or set up a simple investment plan inKBC Mobile. The choice is yours!

If you have a stable income, you can apply for a free credit card and have it linked to your young person’s account. Bear in mind that your application has to be approved first.

- Make payments and withdraw cash worldwide

- Spread your repayments over several months if you wish

- Set your own payment limit

If you don't have a steady income, you can always go for the KBC Prepaid Card, an equally convenient alternative for just 1 euro a month!

*Remember, borrowing money also costs money

You might find what you’re looking for here:

- Pay by contactless with your two debit cards

- If you've forgotten your debit card, use your phone to withdraw cash thanks to MobileCash

- Bank online with your smartphone, tablet or computer

- Personalise your debit cards with a favourite photo twice a year

- Make instant credit transfers (your money is credited immediately to the beneficiary's account)

- Enjoy great extras in KBC Mobile, including Goal Alert, Apple Pay and a digital safe

Like to open your account from the comfort of home and start using it right away? It can be done quickly and easily online.

If you prefer to open it in person, make an appointment at a KBC branch near you.

Whatever way you go about it, you’ll get a handy power bank as a welcome gift!

A handy power bank! Small enough to take anywhere, but powerful enough to fully charge your phone. Rest easy when you’re out and about, knowing you can be contacted at all times no matter where.

- Charge your phone wirelessly or with a cable

- Good for one charge in less than 3 hours

- Compatible with both iOS and Android

If you’re opening your account online, be sure to download KBC Mobile. You’ll then receive a message from Kate telling you to pick up your power bank at a branch of your choice. The ideal opportunity for us to quickly get acquainted!

If you open your account at one of our branches, you’ll receive your gift while you’re there!

It couldn’t be easier with our free bank switching service. Make your request and your balance, wages and direct debits will all be transferred automatically. You don't have to do anything else!

First open your free young person’s account and then simply start your bank switch in KBC Mobile. Alternatively, just ask Kate to start it for you!

The KBC Plus Account is free of charge for under-25s. You must be 18 or older to open the current account for yourself.

The KBC Credit Card is issued by KBC Bank NV, with registered office at Havenlaan 2, 1080 Brussels, Belgium.

VAT BE 0462.920.226, RLP Brussels, FSMA 026256 A.

Lender and card issuer: KBC Bank NV. Subject to your card or credit application being approved by KBC Bank NV.

Form of credit: open-ended credit facility in the form of an arranged overdraft on an account.

Your intermediary is the first point of contact for any complaints you may have. If no agreement can be reached, please contact KBC Complaints Management, Brusselsesteenweg 100, 3000 Leuven, complaints@kbc.be, tel. + 32 16 43 25 94 or contact ombudsman@ombudsfin.be, www.ombfin.be. This does not affect your legal rights either.