Apply for a debit card

- Pay anywhere in the world (including by contactless)

- Use your card for large or small purchases or payments

- Personalise your card with your own photo

Why go for a KBC Debit Card?

- Pay quickly and securely in-store and online

- Easily withdraw cash at ATMs

- Can be used anywhere in the world accepting Bancontact or Mastercard

Where can you use the KBC Debit Card?

1. In Belgium

Withdrawing cash, transferring money and checking your balance are just some of the things that can be done at KBC ATMs or CASH points.

You can also pay in-store or online as standard using your debit card.

2. Abroad

As standard, your KBC Debit Card can be used only in Europe (including the European overseas territories, Turkey and six other countries).

If you’re planning to travel outside Europe, ask Kate – your digital assistant in KBC Mobile – to temporarily activate your card for worldwide use or for worldwide use excluding the USA. If you don't have KBC Mobile, do this using KBC Touch, contact KBC Live or go to your branch.

Learn more about the KBC Debit Card.

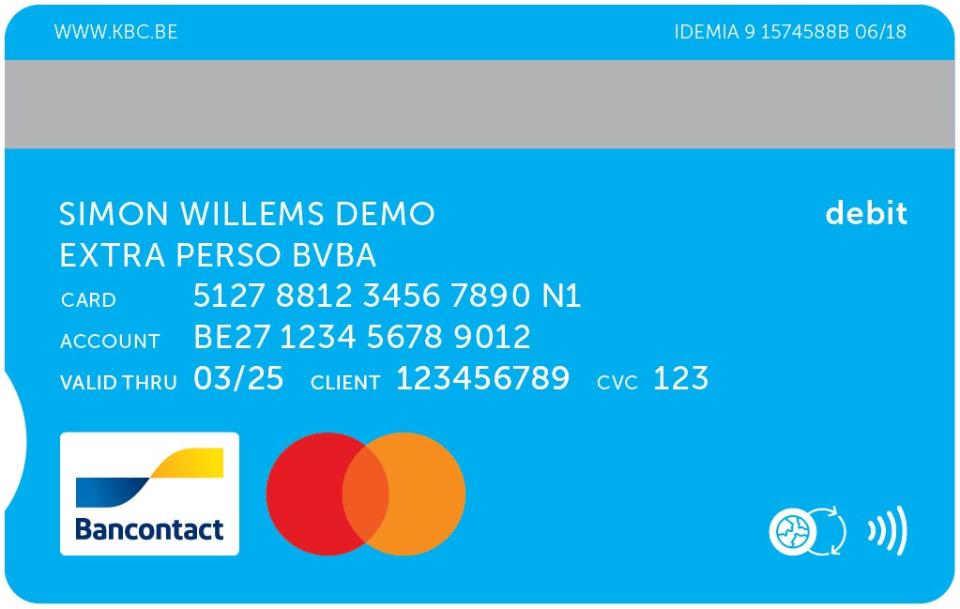

You’ll recognise your card right away by the notch on its side, which distinguishes it from the other cards in your purse or wallet. This feature also helps you identify the correct way to insert the card into a payment terminal or ATM.

Front

Give your card a personal touch by putting a photo of your choosing on the front.

Back

Your card details and the Bancontact and Mastercard logos can be found on the back of your card.

A more sustainable card

Your card is made from fully recycled PVC. That is a saving of 21 tonnes of CO2 for all our payment cards1, or the equivalent of roughly 1.75 hectares of forest².

1 Figures calculated by Gingko 21, the environmental consultancy of payment card manufacturer, Idemia.

2 Source: Encon – 1 hectare of forest = 12 tonnes of CO2

Want a new debit card for yourself, your partner or one of your children? Like to share an account with your partner and need an additional debit card to be able to do so? Or got a defective debit card and want to replace it?

Whatever the reason, check first that you meet these criteria:

- You have a current account

- You are at least 10 years old

- You are domiciled in Belgium

You don't have to enter your PIN for payments of up to 50 euros. Simply hold your card against the device and confirm by pressing ‘OK’. Payment terminals where you can pay by contactless have the same radio wave symbol that you see on your card.

Contactless payments are possible not only by debit card, but also with Apple Pay or Google Pay on your smartphone. Life just got a whole lot easier, especially if you’re in a hurry or have forgotten your card.

If you’d rather not use your card’s contactless feature, just switch it off using KBC Mobile or KBC Touch. You can also ask Kate, your digital assistant in KBC Mobile, to deactivate the contactless payment function.

Standard limits

| Adults | Minors | |

| Daily limit for cash withdrawals | 650 euros | 120 euros |

| Weekly limit for cash withdrawals | 2 500 euros | 900 euros |

| Weekly limit for payments | 2 500 euros | 900 euros |

Want to raise your limits, change your PIN or block your card? Wondering what it costs to use your card abroad? See all you can do with your KBC Debit Card. Or ask Kate, your digital assistant in KBC Mobile.

Maximum limits

| Adults | Minors | |

| Daily limit for cash withdrawals | 2 500 euros | 500 euros |

| Weekly limit for cash withdrawals | 10 000 euros | 5 000 euros |

| Weekly limit for payments | 10 000 euros | 2 500 euros |

| PINless payments | 50 euros per purchase | 50 euros per purchase |

| KBC Basic Account | KBC Plus Account | |

| Debit card | ||

| Second debit card | 0.75 euros a month | |

| Additional debit card | 0.75 euros a month | 0.75 euros a month |

| Replacement debit card | 9 euros per replacement | |

| Personalised debit card | 10 euros | Included (twice a year) |

The Mastercard-branded card that replaces your Maestro-branded card has a different number. That means you’ll need to see to it that your new number is used if you:

- have given an online shop permission to save your card’s number

- have a subscription linked to your card

- use Apple Pay, Google Pay, Garmin Pay or Fitbit Pay

Your Mastercard-branded KBC Debit Card has a Card Verification Code (CVC) you have to enter, along with your card’s number and expiry date, each time you make an online purchase with Mastercard. You never need to enter your CVC when buying something using Bancontact.

You can keep using your card until it expires, after which you’ll automatically receive a new Mastercard-branded KBC Debit Card. Everything is taken care of for you, so you don’t have to do anything yourself.

If your card is defective or has been blocked by Card Stop, you’ll likewise receive a new Mastercard-branded card.

An amount is reserved when a transaction is already known but still has to be processed. The amount concerned is deducted from the available balance on your account.

Amounts are often pre-authorised when you refuel or make payments with Mastercard or Maestro. If amounts have been reserved, they appear at the top of your list of transactions and have an ‘R’ beside them.

Amounts remain on temporary hold for a few days at most. Exceptionally, though, an amount can remain reserved as a security deposit for 30 days or longer. Once the payments have been processed, they will appear in your list of transactions. You can see how long amounts are on temporary hold in KBC Mobile or KBC Touch. If you want to avoid them, you should pay with your credit card or prepaid card.