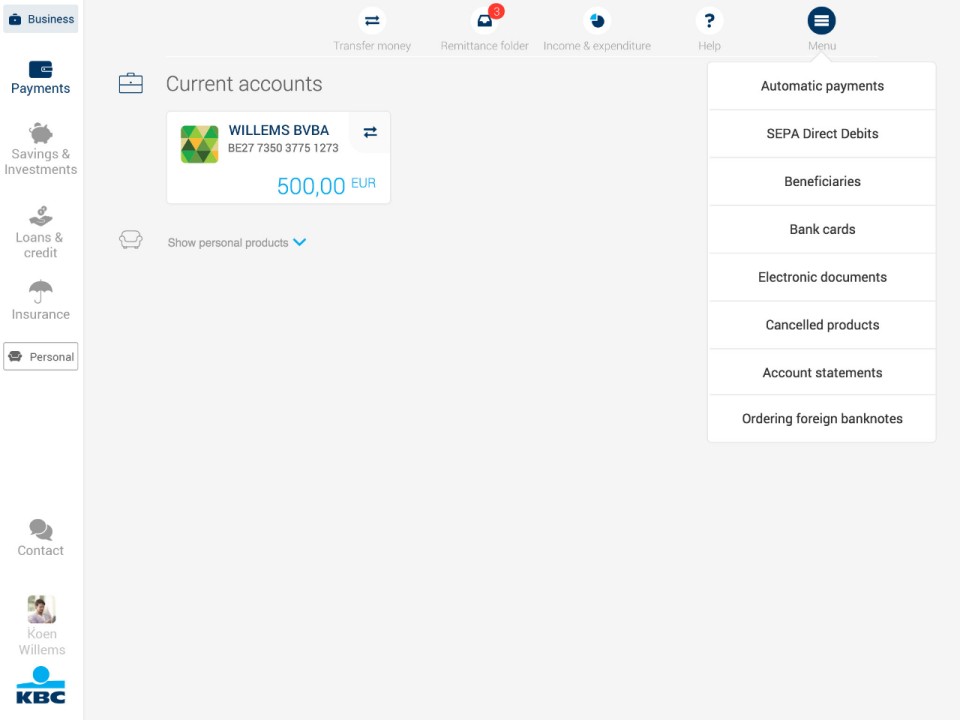

Switch easily between business and personal accounts

The colour coding in KBC Touch shows you at a glance which transactions are business and which personal, giving you a clear view of your banking at all times.

See your cash flows at a glance

Get a clear view of your income and expenditure with graphs you can activate for specific periods. Group together the details you want to display.

Categorise your beneficiaries

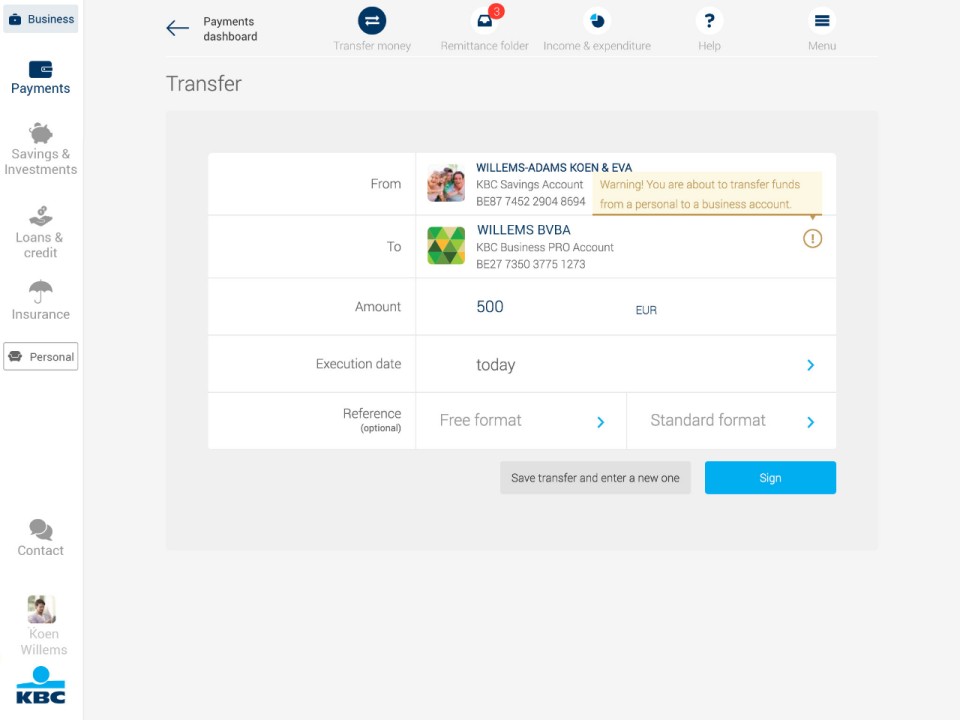

Classify new beneficiaries as personal or business-related so Touch warns you of transactions between the two.

Get to know the various options better

Questions about business accounts in Touch?

Features

Keeps your personal and business accounts neatly apart

With KBC Touch, you can easily toggle between your personal and business accounts.

- The clear colour classification lets you see at a glance which transactions are business-related and which are personal.

- You also have the option of hiding one or the other of them, so you can focus on just your personal or just your business transactions.

Customised classification of beneficiaries

FAQs on business accounts

Can I always see my personal accounts first, then my business accounts (or vice versa) after logging in?

Can I see the balance on an account that belongs to a third party?

Can I open or close an itemised account under 'Funds belonging to third-parties'?

No, you can only do that at your KBC Bank branch. If you've signed up to KBC-Online for Business, you can do it online. For more information, contact your KBC Bank branch.