The era of the e-invoice is already taking shape!

From 1 January 2026, electronic invoicing, or e-invoicing, will become mandatory for Belgian companies. What will that mean for you and your business? On this page, you will find answers to some important questions around e-invoicing.

With e-invoicing, invoices are created, sent and received electronically. A PDF invoice sent by e-mail is thus not an electronic invoice and will therefore no longer be legally valid in the future. Moreover, invoices sent and received in PDF format by e-mail will be phased out, as will invoices printed and sent by post.

They will be replaced by the electronic invoice, also known as an e-invoice. An electronic invoice is an invoice that is created, sent and received in a structured electronic format (XML format), allowing it to be processed automatically and electronically. E-invoicing will therefore involve automating the entire invoicing process from start to finish. That’s very convenient because automatic processing is faster, safer, cheaper and leads to fewer errors. Naturally, you will also need to make some changes in order to be able to send and receive e-invoices

- Payments are collected faster thanks to the more rapid approval and payment process.

- There is less risk of errors such as misplacing invoices or entering incorrect data.

- Improved communication between buyer and supplier ensures faster resolution of disputes and timely payment of invoices.

- More transparent cash flow thanks to real-time monitoring of billing and payment status.

- Reduced invoice fraud as e-invoices are sent via the secure Peppol network. Electronic invoices are encrypted and cannot be intercepted.

E-invoices are sent in Belgium via the Peppol network

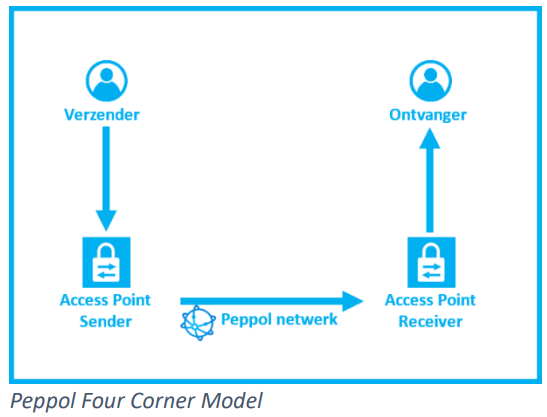

Peppol is a secure network that can only be accessed through a certified access point provider. This closed network ensures that sensitive financial data, such as e-invoices, can be exchanged securely between senders and recipients. Peppol is also increasingly recognised and used as a standard outside Europe.

To send and/or receive files via Peppol, you need access to a Peppol Access Point: These Access Points receive messages from senders and forward them to the recipient's access point, which receives it from the Access Point. Once the connection to the Peppol Access Point has been configured, invoices can be sent and received automatically. If your invoicing package can handle it, new invoices can be sent automatically once they have been created. If your accounting software supports it, your electronic invoice can also be processed automatically immediately upon receipt. Peppol can also do more than just send invoices. It is a platform that can support the entire procurement process.

Simply put, the Peppol network will replace sending invoices by post and e-mail.

You will find more information on our KBC Invoicing Services page.

E-invoicing is currently partially mandatory in Belgium. In 2026, mandatory e-invoicing will be extended to include B2B invoicing.

B2G: Business-to-Government

If you invoice the government, in most cases you are already required to send electronic invoices.

Since 1 March 2024, only invoices under 3 000 euros are exempt from this requirement; for all other orders, e-invoicing is mandatory. Moreover, any level of government can decide not to apply the above exemption. Government authorities in Belgium receive their e-invoices through the Mercurius platform. This is a federal platform to which all Belgian governments are affiliated, and which can be accessed through Peppol.

B2B: Business-to-Business

At present, you can still create your B2B invoices as PDFs, or even send them by post. However, this is set to change in the near future.

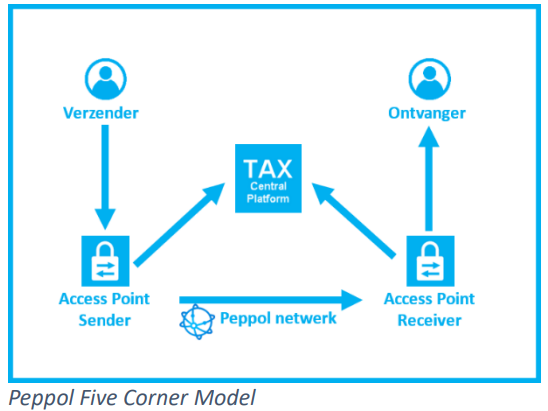

From 1 January 2026, e-invoicing will become mandatory for all B2B transactions in Belgium. Belgium will adopt the Peppol framework, the standard for B2B e-invoicing that is also used for B2G transactions, based on the ‘four corner model’. Over time, the ‘four corner model’ will evolve into a format which also incorporates the VAT return, for example the ‘five corner model’, in which a connection is provided to a government platform for VAT check and processing.

B2C: Business-to-Customer

Currently, there are no indications that mandatory e-invoicing will also be introduced for private individuals in the future.

The situation in different EU Member States varies. Each country is working hard to comply with the roadmap draw up at European level.

For B2B invoicing, in particular, it is likely that governments will set out a timeframe for the roll-out of mandatory e-invoicing.

The current status of e-invoicing in our neighbouring countries and some other countries in Europe is set out below.

There are no immediate plans for the implementation of e-invoicing for B2C transactions in any of these countries.

Country |

E-invoicing mandatory or not mandatory for B2B |

Luxembourg |

Optional |

Netherlands |

Optional |

Germany |

Phased implementation from 2025 |

France |

Mandatory from 1 September 2026 (via Chorus Pro) |

United Kingdom |

Optional |

Between companies in different European Member States |

Mandatory from 2028 |