The object of Optimum Fund Enhanced Intelligence Global Allocation Responsible Investing is to achieve the highest possible return by investing directly or indirectly in various asset classes, such as shares and/or share-related investments (the ‘stock component’), bonds and/or bond-related investments (the ‘bond component’), money market instruments, cash and cash equivalents, and/or alternative investments (including real estate and financial instruments that are linked to price movements on the commodity market).

The target allocation is 55% for the stock component and 45% for the bond component. Deviation from the target asset allocation is possible on the basis of various mathematical models The portfolio allocation is generally a balanced mix between shares and bonds.

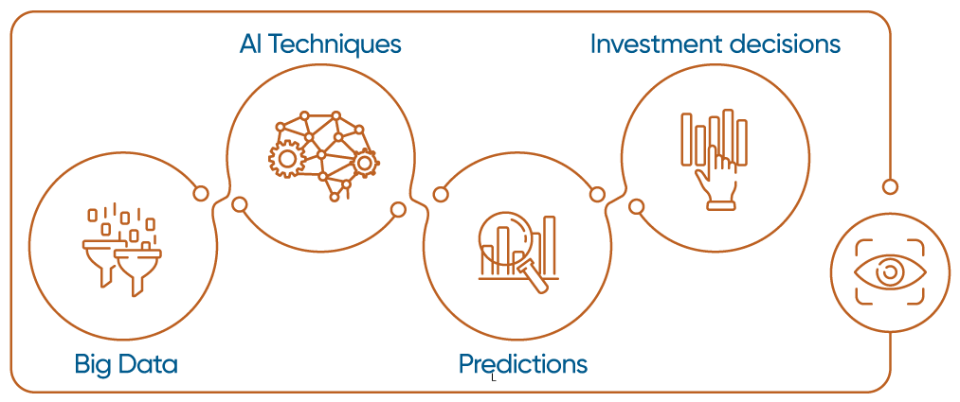

These models use market and economic data to generate expectations or forecasts regarding the performance of financial markets and asset classes. This data is carefully selected by experts at KBC Asset Management NV.

KBC Asset Management NV first decides which asset classes, regions, sectors and themes are eligible for investment. The models then apply a variety of artificial

intelligence techniques to the generated expectations or forecasts to help determine on a daily basis the population or diversification of the stock component and bond component across the eligible regions, sectors and themes. Use can also be made of sentiment data to determine the content and the spread of the stock component. Examples of this can be the sentiment expressed in news articles or the quantity of publications about a particular company The influence of artificial intelligence is more limited for populating the bond component than for the stock component or for determining the allocation between asset classes (for more details, see the ‘selected strategy’ section in the information concerning this sub-fund in the prospectus).

However, the fund manager may decide at any time not to follow the models or to follow them only partially. Human intervention is more likely in exceptional

circumstances.

It is possible for the fund to invest in asset classes that are not included in the target allocation.

The stock component is invested in a worldwide selection of shares. The bond component is invested in a worldwide selection of bonds. The credit rating* that the bond component must meet is set out in the prospectus (for more details, see the 'Investment details' section in the information concerning this sub-fund in the prospectus). Investments in both components may be made in any region, sector or theme.

Within the limitations described above, the fund pursues responsible investing objectives based on a dualistic approach: a negative screening and a positive

selection methodology.

The negative screening entails that the fund may not invest in assets of issuers that are excluded based on exclusion criteria (including tobacco, gambling activities and weapons). More information on the exclusion policy can be found at www.kbc.be/investment-legal-documents > Exclusion policy for Responsible Investing funds.

The positive selection methodology is a combination of portfolio targets and supporting sustainable development.

Portfolio targets are based on a reduction in greenhouse gas intensity and an improvement in ESG characteristics versus its benchmark.

Sustainable development is supported by investing in green, social and sustainability bonds and in issuers contributing to the UN Sustainable Development Goals.

More information on the positive selection methodology and the concrete goals of the fund can be found at www.kbc.be/investment-legal-documents > Investment policy for Responsible Investing funds and in the annex to the prospectus for this fund.

Optimum Fund Enhanced Intelligence Global Allocation Responsible Investing is actively managed with reference to the following composite benchmark: 55%

MSCI All Countries World Net Return Index, 22.5% JP Morgan EMU Government Bonds Investment Grade ALL Maturities Total Return Index, 22.5% iBoxx Euro

Corporates Total Return Index.

The fund does not aim to replicate the benchmarks. The composition of the benchmark is taken into account when compiling the portfolio. Due to the

aforementioned responsible investing methodology, the composition of the portfolio will differ from that of the benchmark. The benchmark is also used to assess the performance of the fund. The benchmark is also used to determine the fund's risk limitation mechanism. This limits the extent to which the fund's return may deviate from the benchmark.

The long-term expected tracking error for this fund is 2%. The tracking error measures the volatility of the fund's return relative to that of the benchmark. The higher the tracking error, the more the fund's return fluctuates relative to the benchmark. Market conditions may cause the actual tracking error to differ from the expected tracking error.

Optimum Fund Enhanced Intelligence Global Allocation Responsible Investing may make limited use of derivatives*. This means it can use derivatives to help

achieve the investment objectives (for instance, to increase or decrease exposure to one or more market segments in line with the investment strategy) or to

neutralise the portfolio’s sensitivity to market factors (such as by hedging an exchange rate risk). The manager can make significant use of derivatives involving the assets of issuers that do not have a responsible character.

The portfolio can be populated primarily through funds managed by a KBC group company based on criteria such as how transparent the investment policy of those funds is and whether or not their strategy is in line with this fund's investment strategy.

The fund is denominated in Euro.