Is your teenager ready for more power?

Is your teenager still a minor but ready to embrace a little more independence? With KBC’s free young person’s account, they can learn about banking while you keep a parental eye on things. Not only that, they’ll also get a handy power bank to keep their phone powered up while they’re out and about!

Open a free young person’s account and get a power bank

Ever considered opening a current account for your teenager? KBC's young person’s account is the ideal starter account to help your child learn about banking while you keep a watchful eye on them. It offers all the benefits of the KBC Plus Account, but is totally free for 10- to 24-year-olds.

If you open a young person’s account now, your teen will receive a handy power bank as a welcome gift.* Ideal for boosting their smartphone battery when they’re at holiday camp or out and about with friends!

* While stocks last.

Your teenager learns about banking but you stay in charge

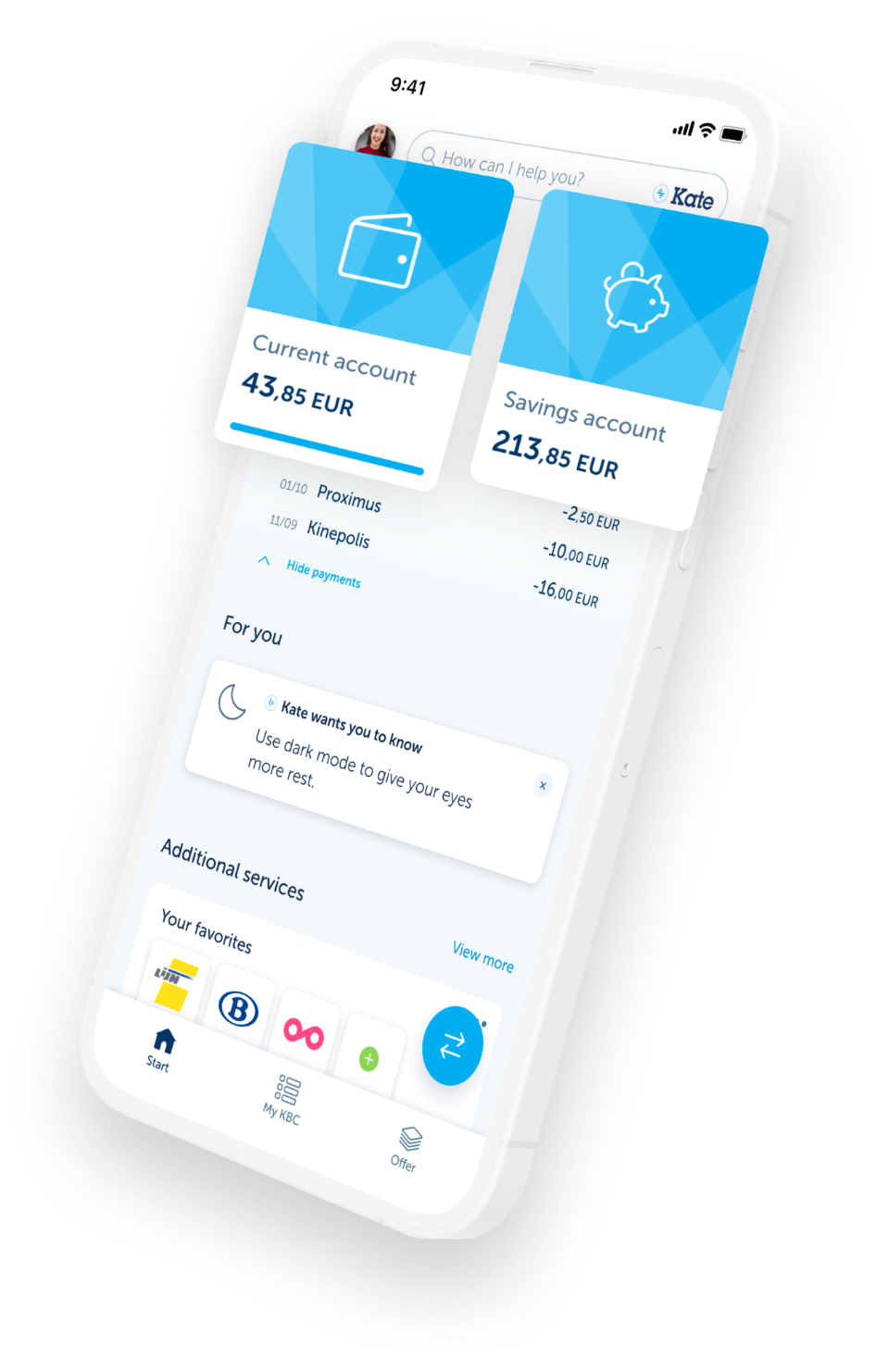

- Your teen learns how to become money savvy with KBC Mobile

- You get to keep a parental eye on their income and expenditure

- You set the limits for payments and cash withdrawals

- You decide whether your child can pay online or see their own savings account

- Your teenager gets to enjoy all the benefits of the KBC Plus Account for free until they turn 25

Teach your child to bank with the best banking app in Belgium

KBC Mobile has more than once been named the best banking app in Belgium. Your teenager can use it to practise for their driving theory test, buy a bus or train ticket in just a few taps or split the takeaway pizza bill with friends.

Kate, the digital assistant, is also available around the clock to answer questions or perform certain tasks.

What comes with the young person's account?

Our young person’s account is a KBC Plus Account that is free for 10- to 24-year-olds. It includes:

- Two customisable debit cards (personalised with a favourite photo)

- App notifications when money is paid into the account

- Instant credit transfers (money credited immediately to the account)

- Contactless payments made using a debit card, smartphone or smartwatch

- Access to additional features such as Apple Pay and Goal Alert

1. Open a young person’s account for your teenager

Before you can open a young person’s account for your child, you first have to add their details to your family situation in KBC Mobile or KBC Touch. After doing so, you can then open the account.

2. Set up KBC Mobile for your teenager

You can activate KBC Mobile for them in two steps. First, set up everything on your own smartphone and generate a QR code. Then download the KBC Mobile app on your child's smartphone and scan the QR code.

3. Receiving the free power bank for your teenager

When you open the young person’s account, Kate will send you an invitation in KBC Mobile to pick up the power bank at a KBC branch of your choice. If you open the account in a branch, you’ll receive it right away.

Not a KBC customer?

Why not drop into one of our branches and get to know us first. Make an appointment at a KBC branch near you.

The KBC Plus Account is free of charge for under-25s. You must be 18 or older to open the current account for yourself.

The KBC Credit Card is issued by KBC Bank NV, with registered office at Havenlaan 2, 1080 Brussels, Belgium.

VAT BE 0462.920.226, RLP Brussels, FSMA 026256 A.

Lender and card issuer: KBC Bank NV. Subject to your card or credit application being approved by KBC Bank NV.

Form of credit: open-ended credit facility in the form of an arranged overdraft on an account.

Your intermediary is the first point of contact for any complaints you may have. If no agreement can be reached, please contact KBC Complaints Management, Brusselsesteenweg 100, 3000 Leuven, complaints@kbc.be, tel. + 32 16 43 25 94 or contact ombudsman@ombudsfin.be, www.ombfin.be. This does not affect your legal rights either.