This fund focuses on real estate themes in our rapidly changing society

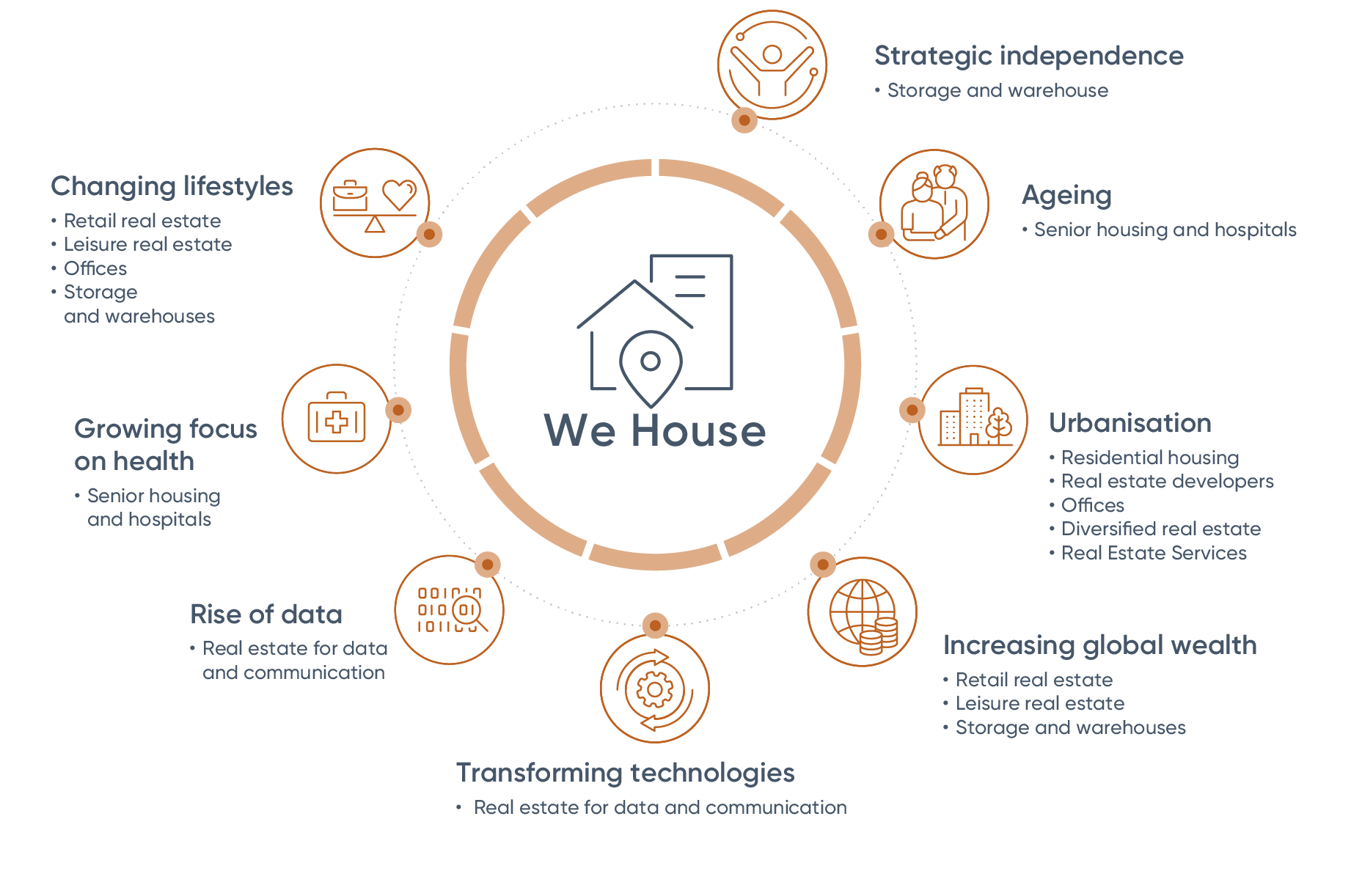

Major trends such as urbanisation, increasing global wealth, demographic ageing, the rise of data and transformational technologies are impacting the supply and use of existing and new real estate, as illustrated by:

- a focus on more climate-friendly properties

- affordable housing

- the breakthrough of AI and growing demand for data centres.

At the same time, the related services for buyers/sellers, landlords/tenants and property developers are also changing.

This fund provides a fine alternative to investing in physical real estate and enables you to spread risk effectively due to the wide thematic range covered. The fund invests in property markets that would otherwise be difficult to access for an individual, such as data centre, transmission tower, warehouse and residential care centre markets.

Steven Vermander, Analyst at KBC Asset Management

Invested primarily in an internationally diversified portfolio of real estate

The manager does not invest directly in real estate, but rather in real estate certificates, shares of real estate companies and real estate funds, as well as other securities linked to the real estate sector. These companies are active in such areas as:

- Residential real estate: including houses, flats and student accommodation

- Retail real estate: including peripheral retail properties and shopping centres

- Leisure real estate: including hotels, resorts and hospitality establishments

- Senior housing and hospitals: including residential care centres and service flats

- Real estate developers

- Offices

- Real estate for data and communication: including data centres and transmission towers

- Storage and warehouses

- Real estate services: including estate agents and real estate websites

- Diversified real estate: companies operating in different areas of real estate.

Invested in a responsible manner

By opting for this responsible fund, you exert a positive influence on the world we live in. In this regard, the fund invests in companies and/or countries that contribute towards:

- achieving specific targets relating to the environment, social issues and corporate governance (ESG) and a reduction in greenhouse gas intensity (CO2),

- achieving the United Nations Sustainable Development Goals.

Companies that specialise in controversial activities (such as tobacco, gambling and weapons) are excluded.

When deciding to invest in this fund, you should also consider all the other features and objectives of the fund.

What can you expect from this product?

- Actively managed real estate fund

- Responsible investment

- In euros

- No maturity date, no capital protection and no guaranteed return

- Withdrawable on a daily basis

Risks

- The Risk indicator is 4 on a scale of 1 (lower risk) to 7 (higher risk).

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you.

4 is typical for an equity fund and indicates that the fund is highly sensitive to the markets. Indeed shares do not provide a guaranteed return and their value can fluctuate sharply.This product does not include any protection from future market performance so you could lose some or all of your investment..

- High exchange rate risk: Since there are investments in securities that are denominated in currencies other than the Euro, there is a considerable chance that the value of an investment will be affected by movements in exchange rates. There is no capital protection.

Charges

- Entry charge: 3%

- Exit charge: None, except 5% if you exit within a month of entry

- Ongoing charges: 2.08%, factored into the net asset value.

- Anti dilution levy: in exceptional situations*

*When net subscriptions and redemptions involve exceptionally large amounts, KBC Asset Management may decide to apply an additional charge to the investors concerned [those entering or exiting the fund on that day] to mitigate the negative impact on the net asset value. The size of this levy is based on the transaction charges incurred by the manager. Applied in very exceptional situations, this levy is in the interests of those investors remaining in the fund. See section 'G. Fees and charges regarding the Bevek' in the prospectus.

Taxes

- Withholding tax on dividends: 30%. Only for Distribution Shares.

- Withholding tax upon exit: No

- Stock market tax upon exit: 1.32% (max.4,000 euro). (only for capitalisation units)

Applies to individual investors who are subject to Belgian personal income tax.

Investment policy

The sub-fund invests primarily in an internationally diversified portfolio of real estate certificates, shares in real estate companies and real estate funds, and in other real estate-related securities of companies whose real estate solutions and services respond to urbanization, increasing global wealth, aging populations, advance of data and transformative technologies, such as:

- Residential real estate

- Retail real estate

- Leisure real estate

- Healthcare real estate

- Real estate developers

- Office property

- Real estate for data and communications

- Storage and warehouses

- Diversified real estate

- Real estate service providers

- etc

A current overview can be found at www.kbc.be/thematic-funds.

The fund pursues responsible investing objectives based on a dualistic approach: a negative screening and a positive selection methodology.

The negative screening entails that the fund may not invest in assets of issuers that are excluded based on exclusion criteria (including tobacco, gambling activities and weapons). More information on the exclusion policy can be found at www.kbc.be/investment-legal-documents > Exclusion policy for Responsible Investing funds.

The positive selection methodology is a combination of portfolio targets and supporting sustainable development. Portfolio targets are based on a reduction in greenhouse gas intensity and an improvement in ESG characteristics versus its benchmark. Supporting sustainable development is done by investing in green, social and sustainability bonds and in issuers contributing to the UN Sustainable Development Goals.

More information on the positive selection methodology and the concrete goals of the fund can be found at www.kbc.be/investment-legal-documents > Investment policy for Responsible Investing funds and in the annex to the prospectus for this fund.

More sustainability-related disclosures can be found at www.kbc.be/en/SRD.

KBC Select Immo We House Responsible Investing is actively managed with reference to the following benchmark: MSCI All Countries World - Net Return Index (www.MSCI.com).

However, is not the aim of the fund to replicate the benchmark. The composition of the benchmark is taken into account when compiling the portfolio.In line with its investment policy, the fund may not invest in all the instruments included in the benchmark.

When compiling the portfolio, the manager may also decide to invest in instruments that are not included in the benchmark, or indeed not to invest in instruments that are included .

Due to the aforementioned responsible investing methodology, the composition of the portfolio will differ from that of the benchmark.The benchmark is also used to determine the fund's risk limitation mechanism. This limits the extent to which the fund's return may deviate from the benchmark.

The longterm expected tracking error for this fund is above 4.00 %. The tracking error measures the volatility of the fund's return relative to that of the benchmark. The higher the tracking error, the more the fund's return fluctuates relative to the benchmark. Market conditions may cause the actual tracking error to differ from the expected tracking error.KBC Select Immo We House Responsible Investtingmay make limited use of derivatives*. This means that derivatives can be used either to help achieve the investment objectives (for instance, to increase or decrease the exposure to one or more market segments in line with the investment strategy), or to neutralise the portfolio’s sensitivity to market factors (by hedging an exchange rate risk, for example).

The fund is denominated in Euro.

The fund reinvests any income received in the manner set out in the prospectus (for more details, see section 'Types of units and fees and charges' of the information for this sub-fund in the prospectus).

The above objectives and investment policy have been taken in their entirety from the Key Information Document (KID). Neither the capital nor the return is guaranteed or protected.

More things you need to know

This information is governed by the laws of Belgium. Please read the Key Information Document and the prospectus before subscribing. Both documents are available free of charge in Dutch and English (and in French for the key information document) from your KBC or CBC branch or at www.kbc.be/investment-legal-documents or www.cbc.be/documentation-investissements. You will also find a summary of your rights as an investor there in Dutch, English, French and German.

The net asset value can be found on www.beama.be, in KBC Mobile or CBC Mobile.

If you have a complaint, the contact details for KBC are complaints@kbc.be, tel. 016 43 25 94 or ombudsman@ombudsfin.be and the contact details for CBC are gestiondesplaintes@cbc.be, + 32 81 803 163 or ombudsman@ombudsfin.be for CBC.

* For the complete overview of financial and economic terms, go to www.kbc.be/lexicon of www.cbc.be/lexique.